THE PHILIPPINE ECONOMY… WILL IT BE POST-ELECTION “DADDY ISSUES” FOR FRONTRUNNER MARCOS?

By Martin Yupangco & Paul Gary Bograd

Download a PDF copy.

Former Senator Ferdinand Marcos Jr. and presidential daughter Davao City Mayor Sara Z. Duterte are running for president and vice president, respectively, in the 2022 national and local elections. | PNA photo by Joey O. Razon, Public domain, via Wikimedia Commons.

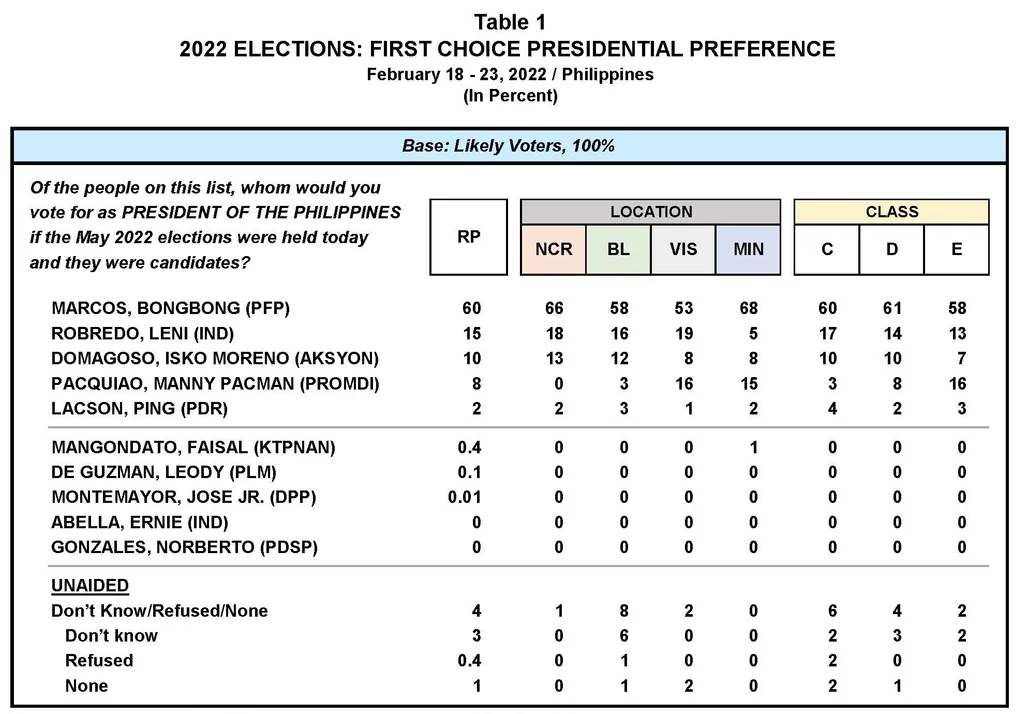

With about seven weeks of active campaigning left in the Philippine Presidential election, it is appearing more likely that Ferdinand Marcos Jr. will become the next President of the Republic of the Philippines (As a caveat to this statement, it is essential to note that Philippine voters are volatile and both digital and traditional “word of mouth” can move public opinion very quickly). Having said that, Marcos is leading the race in reputable public and private polling by margins ranging from 20%-45%. The means of electoral communication are limited; with only one national television news channel, only one national television network for campaign advertising, and effective national broadband penetration is well below the 70% of the population with basic internet access.

With this in mind, it is appropriate to begin to exert some foresight into the basic economic directions of an incoming Marcos administration.

Former Senator Ferdinand "Bongbong" Marcos Jr. leads the presidential race survey conducted by Pulse Asia last February 18 to 23.

Genetics and Reality: A Bit of Context

Let us begin by saying it would be a mistake to automatically assume that the economic flaws and corruption allegations that most use to define the end period of candidate Marcos’ mother and father are inevitable to be repeated.

While not perfect, transparency of the Philippine budgetary process and international monetary movement safeguards make the scale of corruption alleged of the parents much less likely in the current regulatory and information environment.

On top of this is the role of the Philippine Central Bank, which is generally considered one of the most competent in Asia.

Certainly, an incoming Marcos administration will bring a new set of favored businesspeople and investors. This would be no different than any incoming Philippine administration, including those of past Presidents Corazon Aquino and her son Benigno Aquino III, who are thought by many to be the least corrupted administrations in modern Philippine governments.

Ferdinand Marcos is sworn in as President of the Philippines for the second time in 1969. Philippine Presidential Museum & Library. Public Domain, via Wikimedia Commons.

“Mission Critical” Dynamics Facing an Incoming Marcos Administration

Short Term Debt Challenges:

COVID response and the Russia-Ukraine conflict will add an enormous amount of foreign and domestic near-term debt to the Philippine economy. This near-term debt will be public and private debt and will inevitably reflect in balance of trade indicators.

As we write this today, there is mounting political and popular pressure to suspend energy taxes and other government revenues reductions designed to mitigate price increases to consumers. And these revenue reductions will significantly increase the need for government near-term borrowing.

The Duterte administration will almost certainly take action to mitigate consumer price increases as well as price increases in agricultural inputs like fertilizer and agri-chemicals. In an economy so import dependent, government measures to mitigate price increases will almost certainly take the route of tariff reductions and quota expansion. Both actions will increase pressures for government borrowing.

While this could cause additional governmental revenue reduction, it provides a significantly less fiscally dangerous alternative to suspension of government taxes, which are notoriously difficult to reinstate once suspended.

Short Term Debt Will Likely Be Manageable for an Incoming Marcos Administration:

As we write this today, there is mounting political and popular pressure to suspend energy taxes and other government revenues reductions designed to mitigate price increases to consumers. And these revenue reductions will significantly increase the need for government near-term borrowing.

The Duterte administration will almost certainly take action to mitigate consumer price increases as well as price increases in agricultural inputs like fertilizer and agri-chemicals. In an economy so import dependent, government measures to mitigate price increases will almost certainly take the route of tariff reductions and quota expansion. Both actions will increase pressures for government borrowing.

While this could cause additional governmental revenue reduction, it provides a significantly less fiscally dangerous alternative to suspension of government taxes, which are notoriously difficult to reinstate once suspended.

Long Term Effects of Increased Debt and Decreased Government Revenue Reductions Will Limit New Infrastructure and “Big Spend” Government Initiatives

Competent management of public finance in the past three Philippine Presidential administrations had placed the Philippines on a fast track to a “debt service to budget”, and “debt to GDP”, ratios that portended an optimistic financial future. The significant increase in near-term government and private sector debt, while meeting immediate economic, political, and public health necessities, will inevitably reverse the Philippines’ progress toward long term debt reduction.

For an incoming Marcos administration, it will place severe limits on the credibility of any sweeping, visionary, big government initiatives that all incoming Presidents are prone to offer. He may still lay out the vision, but its reality will be speculative.

Moreover, the increased near term debt service will create immediate budgetary pressures for any new programs, or even more critically, to maintain spending in response to COVID and Russia-Ukraine war induced economic damage.

One additional factor that is little thought about in the international financial community is something called the Mandanas Ruling. As a result of the Mandanas Ruling by the Philippine Supreme Court in 2018 (and confirmed in 2019) the IRA (funds transferred to Local Government Units) are programmed to increase by 55 percent in the 2022 budget, reaching PHP1.08 trillion, or 4.8 percent of the country’s gross domestic product compared to 3.5 percent of GDP in 2021.

To lessen the fiscal impact of having to transfer more financial resources to LGUs, the national government has started to identify spending responsibilities for select devolved mandates to be transferred back to local government.

However, some local governments have started to raise concerns regarding their financial and technical capacity to absorb re-devolved mandates.

This will present significant complications in delivery of essential government services for an incoming Marcos administration.

On the positive side, it may also create additional opportunities for Local Government Units to engage in their own revenue raising through debt related financial products.

Managing Historical Trade and Economic Perceptions of Marcos’ Political Legacy

While it is difficult to predict the extent and duration of Ukraine–Russia war induced consumer price increases, the import-heavy imbalance of the Philippine economy will require extraordinary measures to both mitigate those price increases and build push back on inflationary pressures.

Perhaps the least structurally damaging pathway to consumer price mitigation and inflationary hedge will be liberalization (even if temporary) of import tariffs and quotas. This would provide immediate price relief and appears to be the pathway chosen by the current Duterte administration.

Moreover, this would be more philosophically consistent with the current Duterte liberal economic policies and statutory achievements in import tariff and quota reforms as well as liberalized laws relating to foreign investment.

It should be noted that many of the Duterte administration’s economic and fiscal reforms have been achieved via a much more sustainable statutory process. However, some of those reforms and the expected tariff and quota response to the war driven price increases will be achieved via the route of Executive Order, which can be ended instantly by the signature of the next President.

For an incoming Marcos administration, this will present unique challenges both to managing economic recovery from the war and what is hopefully a “post-COVID” economic rebuilding.

The toolkit to minimize or mitigate Ukraine–Russia war impact on already burdened Philippine consumer and agricultural population is not very loaded. Trade, tariff and quota interventions may be the only immediate and impactful pathways.

For a potential incoming Marcos administration this will present a significant and unique set of international perception issues.

“Someone once said that every man is trying either to live up to his father’s expectations or make up for their father’s mistakes.”

The economics of his father’s administrations were, to put it kindly, not seen as examples of free and liberal trade policies nor successful macro-economic management. Rightly or wrongly many in both the international and domestic financial and political communities will view an incoming Marcos administration through the prism of the father’s economic legacy. An early challenge for a Marcos Presidency will be to shape its own prism.

How an incoming administration (especially if it is an incoming Marcos administration) manages this pathway will be a powerful predictive indicator of not only its domestic popularity and trust. Trade, tariff and quota policies and interventions will be a powerful indicator of the geo-political and geo-economic positioning of a potential Marcos administration.

International investors, financial institutions and global diplomatic leadership will be well advised to focus on these dynamics as they plan their relationship to the Philippine economy.

DISCLAIMER: The information contained herein is strictly for informational purposes. Optima Strategies Limited and any of its principals or employees are not responsible for its completeness or accuracy. This information is offered as a free service and all receiving parties are advised to confirm any and all information. This document is the proprietary intellectual property of Optima Strategies Limited and should not be copied, circulated to other parties or otherwise used without written permission